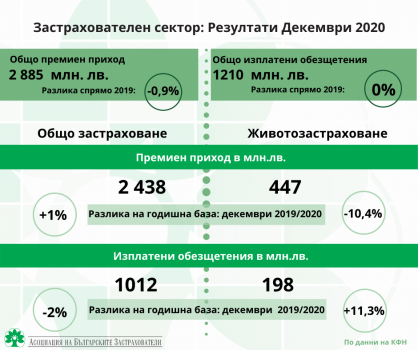

Overall, the impact of the crisis triggered by COVID-19 on the insurance market was reflected in the slowdown of the dynamic growth observed in previous years, keeping results close to the levels of 2019. Data from the Financial Supervision Commission (FSC), including the most recent as of December 2020, confirm this trend. By the end of the fourth quarter, the total premium income of the market amounted to BGN 2,885 million, representing a marginal decline of 0.9 percent compared to 2019. The total amount of paid claims was BGN 1,210 million, practically unchanged from the previous year.

The non-life insurance segment developed steadily despite the broader economic stagnation and ended 2020 with premium income of BGN 2,438 million, an increase of 1 percent year-on-year. Paid claims amounted to BGN 1,012 million, a slight decline of 2 percent compared to 2019.

Stability was also observed in the most common insurance products, Motor Third Party Liability (MTPL) and Motor Casco. Premium income from MTPL insurance reached BGN 1,080 million, recording a minimal year-on-year decrease of 0.9 percent, likely linked to a slight decline of 0.7 percent in the number of active motor vehicles in 2020. Paid claims under MTPL grew by 6.1 percent to BGN 556 million. Premium income in Motor Casco remained almost unchanged, totaling BGN 653 million as of December, a marginal increase of 0.16 percent compared to 2019, while paid claims fell by 3.3 percent.

The data as of the end of the fourth quarter confirmed the positive trend of growth in property insurance observed throughout 2020. In the “Fire and Natural Disasters” line, premium income increased by 4.7 percent year-on-year, reaching BGN 289 million. “Fire and Other Perils” insurance recorded a significant increase of 8.5 percent, amounting to BGN 92 million, while “Theft, Burglary, and Vandalism” insurance grew by 4.2 percent, with premium income of BGN 21 million.

Lines of business related to tourism and travel were among the most affected by the pandemic. While the situation had a strongly negative impact on premium income, clear signs of recovery emerged during the year. In Travel Assistance insurance, for example, the annual decline stood at 49 percent in June but narrowed substantially to just 4.2 percent by December, with premium income reaching BGN 38 million.

The life insurance segment reflected the broader effects of stagnation, economic uncertainty, and the direct consequences of the pandemic for people’s lives and health. Premium income in life insurance fell to BGN 447 million by December 2020, down from BGN 499 million a year earlier. Paid claims, however, increased by 11.3 percent, reaching BGN 198 million. Market data indicate a gradual easing of the decline in premium income: while the decrease as of mid-2020 was 14.3 percent year-on-year, by December it had moderated to 10.4 percent.

The sustainable development of the Bulgarian insurance market is also reflected in the sector’s net profit, which reached BGN 186 million in 2020, an increase of 32 percent compared to 2019. This result was largely driven by the strong performance in non-life insurance, where net profit amounted to BGN 165 million. In contrast, profit in life insurance stood at BGN 21 million, representing a 26 percent decline compared to the previous year.