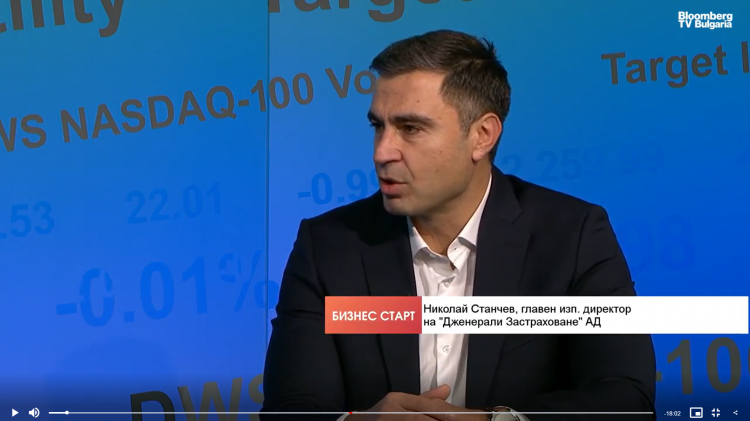

The trends, prospects, and challenges in the insurance sector were among the topics discussed by Nikolay Stanchev, Chairman of the Association of Bulgarian Insurers (ABZ) and Chief Executive Officer of Generali Insurance, in an interview for the “Business Start” program on Bloomberg TV Bulgaria on November 21, 2025.

Stanchev noted that Bulgaria’s insurance market has shown steady growth in recent years. One of the main challenges, he said, is the pace of economic development—when the economy grows, the insurance sector grows as well, and the reverse is also true. Another challenge is the shortage of qualified professionals in the sector. He emphasized the need to update legislation in light of digitalization and artificial intelligence. The upcoming transposition of the European Solvency II directive aims to address existing deficiencies and encourage investments aligned with European policy.

Stanchev pointed out that the structure of the insurance portfolio in Bulgaria continues to be dominated by motor insurance, which holds the largest share. In contrast, property and life insurance remain at very low levels—opposite to trends in more developed European markets. The level of property insurance coverage remains very low: less than 10% of real estate is insured, and a large portion of those policies are required as part of mortgage agreements. The main reasons for this, he explained, are the public’s limited awareness of the benefits and affordability of home insurance, as well as the misconception that insurance is expensive. “People think insurance is costly, but it’s not—it costs around 8 to 12 leva per month,” Stanchev said.

Attitudes such as “it won’t happen to me” and reliance on state aid also have a negative effect. Stanchev stressed that while the state can and should provide initial assistance to disaster victims, it is not its role to restore lost property—that is the function of insurers. “Insurance is the most effective mechanism for protecting people,” he said. One way to encourage more property insurance, he suggested, is to raise public awareness. Other possible measures include introducing certain tax incentives or making insurance mandatory for specific risks, such as natural disasters. Such measures, he noted, can only be developed with state participation.

Health insurance continues to grow at a significant pace, driven in part by rising medical inflation in recent years. Health insurance has become a standard employee benefit, especially among large companies—86% of which offer it to their staff. Stanchev sees strong potential for growth among small and medium-sized enterprises, as it is an important tool for attracting talent in a highly competitive labor market.

In agricultural insurance, there has been a notable increase in interest from producers, thanks to a new scheme under which the State Fund “Agriculture” subsidizes up to 70% of premiums. This interest is expected to continue, Stanchev said, as climate change and more frequent natural disasters make insurance increasingly necessary.

Regarding the upcoming introduction of the “bonus-malus” system, Stanchev noted that individual companies have already been applying their own bonus-malus rules, based on claims data available within their own systems. Under the new legal provisions, however, insurers will have access to the full claims history of each vehicle through the Guarantee Fund’s register, enabling more precise pricing. Each insurer will be able to apply its own methodology for implementing the bonus-malus system.